How to Factor Property Management into Your Budget

Real estate is a legitimate business investment. As such, it’s important to track expenses — past and present — and forecast the future of your properties. You may be wondering, “How do I factor a property management company into my budget while remaining profitable?” It’s simpler than you may think. When you make an agreement with a property management company, they will typically help you determine an operating budget.

What Is an Operating Budget?

An operating budget is an outline of the annual income and expenses associated with real estate properties. Operating budgets include projections for the asset’s long-term viability and each year’s maintenance and operating expenses.

While you can prepare an operating budget for yourself if you tend to manage your properties, property management companies can help you grow your real estate enterprise, pick the ideal tenants, and stay on top of the minute details like taxes, administrative fees, and maintenance supplies.

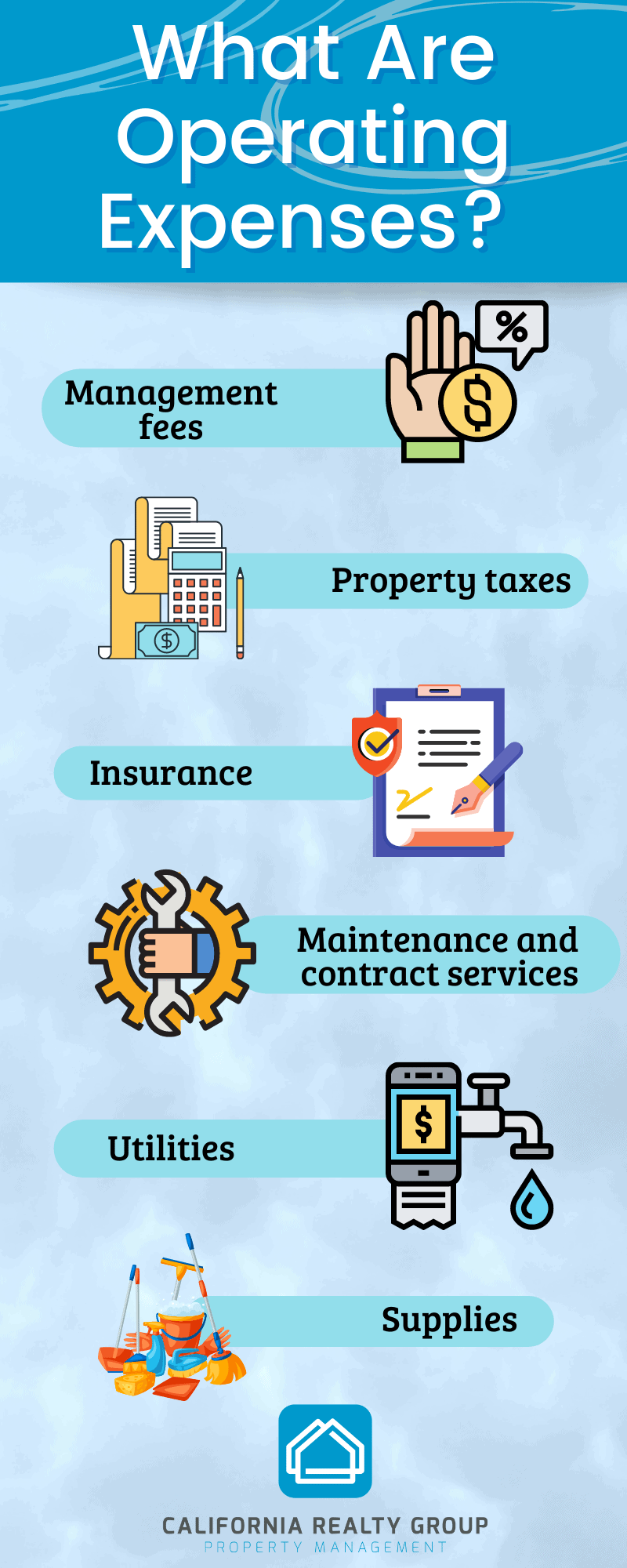

What Are Operating Expenses?

As mentioned above, your operating budget is an outline of your operating expenses, but what expenses fall into this category? Examples of potential operating expenses, also known as opex, include:

- Management and administration fees — that’s right! Property management fees are already factored into your budget.

- Property taxes

- Liability insurance

- Maintenance and contract services such as security, landscapers, lifeguards, and janitorial staff

- Utilities

- Operating supplies

Operating expenses are all expenses directly related to the property. Operating budgets will generally not include extracurricular expenses for marketing, consultant fees, structural repairs and renovations, or debt repayment.

Gross Income Has a Lot to Do With Calculating Operating Expenses

Property management companies will take your gross operating income (GOI) into account when determining your operating budget. Your GOI will include all rental income and other real estate-related sources of revenue, which may include fees for tenant storage, vending machines, and coin-operated laundry.

After the gross operating income of your property is determined, the Opex will be subtracted. The remaining figure is your net operating income (NOI).

What Are the Benefits of an Operating Budget?

Generally, you shouldn’t look at an operating budget as an optional item. Your operating budget is essentially the backbone of your real estate business. Whether you own a single-family rental property or an apartment building, your operating budget can streamline and simplify your business plan.

Your operating budget can help you in the following ways:

- Evaluating performance projections

- Determining your property’s baseline performance to compare against the benefits property management’s performance

- Increasing your understanding of market trends as well as future expenses and income

Among the most important aspects of your operating budget is determining your property manager’s performance. Remember that property management companies will take a portion of your profits, but the expectation is that they will effectively manage your investments. If you find that you do not see the performance you had anticipated, you can compare it against your baseline projections.

An effective property management company will find reliable tenants who pay on time, but they will also efficiently manage maintenance concerns and adjust rental rates as needed to maintain your desired profit margins.

For more information about our property management services, including owner services, in Canyon Lake, Hemet, Lake Elsinore, Menifee, Murrieta, Perris, Romoland, San Jacinto, Sun City, Temecula, Wildomar, and Winchester, don’t hesitate to reach out to our team today!